US-headquartered Oanda has become an established player on the global online brokerage stage over the past twenty years. Today they facilitate forex and index/commodity CFD trading for clients around the world.

This detailed overview of Oanda will cover everything from fees and trading platforms to accounts and regulation.

Risk Warning: CFDs are complex instruments and run a high risk of losing money quickly due to leverage. 73.5% of retail investment accounts lose money trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the huge risk of losing your money.

A brief history

Before we get stuck into the facts and figures of this Oanda dealer review, it might help to first paint a picture of where the Oanda business started and how far they’ve come.

The humble beginnings of Oanda date back to 1996, making it one of the early online brokers. Then it offered investors access to forex and CFDs. Today, however, Oanda is well established in the forex market, offering 124 trading instruments, corporate FX services, currency solutions, as well as exchange rate data for global businesses.

Although headquartered in the US, it has a number of global offices, including Tokyo and London. In fact, Oanda operates in eight global financial centers, with clients in more than 196 countries. It has obtained licenses from key regulatory jurisdictions, including:

- The United Kingdom

- The USA

- Canada

- Japan

- Singapore

- Australia

Although not mentioned in many Oanda review forums, the FxTrade platform, launched in 2001, was actually the first automated forex platform.

You may have seen on Oanda spread betting reviews and forums that the company offers spread betting. Although this is true, it is only available to customers of Oanda Europe Ltd who live in the UK or Ireland.

Minimum initial deposit

Oanda has historically stuck to requiring no minimum initial deposit. This ensures that aspiring day traders and those with limited capital don’t have to deposit more than they can afford as they find their feet. Additionally, Oanda’s minimum lot size is one unit of the base currency of the quote. They also offer nano lots and a very large calculator.

Distributions and commissions

Whether you are looking for an Oanda Europe Limited, Singapore, the Philippines or US price review, Oanda remains extremely competitive regardless of your location.

The distribution of Oanda is comparable to other major companies, such as FXCM and FxPro.

To offer traders the best prices, Oanda uses an automated machine to monitor global prices, and also spreads on the liquidity and volatility of the market. Especially the high volatility can spread. Both current and historical average spreads are clearly laid out, which may provoke the concern of some traders about hidden fees.

This transparent approach was echoed by Vatsa Narasimha, CEO of the OANDA Global Group, who said: ‘We believe that the retail industry as a whole would benefit from a more transparent approach where brokers are held accountable for taking down questionable statements or to falsely disclose their interests . ”

There is an important point to make when comparing Oanda spread with agency brokers (no trading desk). . So just comparing the spread alone cannot always give you a clear conclusion as other factors can sometimes influence the cost of trades over a period of time.

Lever

For those looking to trade on the edge, you’ll find leveraged deals at Oanda. For retail customers, the maximum leverage is determined by regulators in your geographic region, but all Oanda users can reduce their leverage limit further.

It is also worth emphasizing that while you may increase profits, trading on margin can also increase losses. Therefore, using stop loss orders to limit potential losses with leverage is a technique used by many people.

Other Fees

Oanda’s trading fees are simple and very competitive. However, Oanda introduced an inactivity fee in September 2016. Fortunately, this effective tax will only affect those who have no trades for at least two years.

Note that there is no deposit bonus when you sign up with Oanda. It is worth keeping an eye on the official website for changes to overnight (overnight) fees, finance charges.

Oanda Trading Platforms

FxTrade

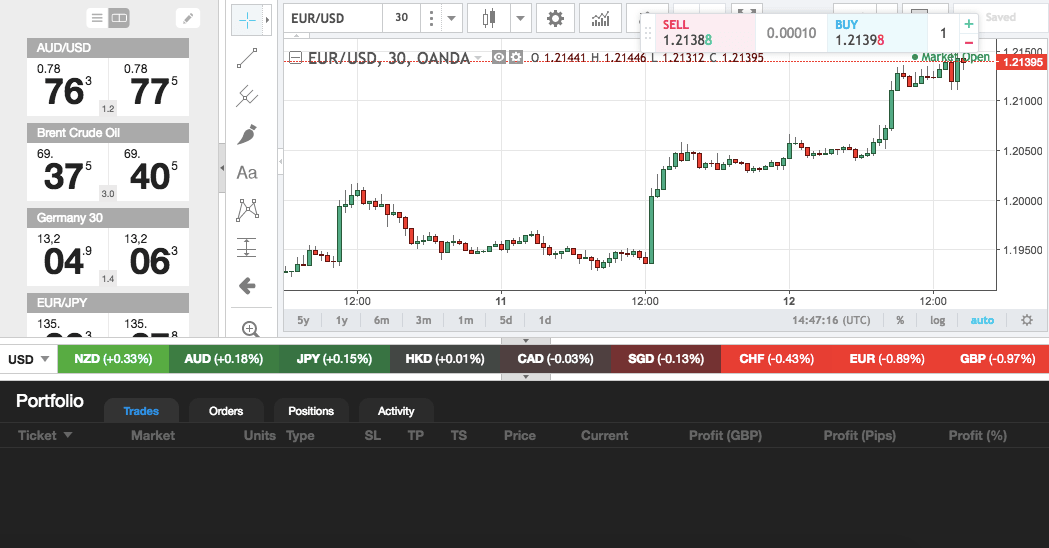

It’s time to move on to the FxTrade part of the review, an important part of the Oanda offering. Overall, the system is well designed and easy to use, offering a variety of tools and analysis.

You can trade directly from the chart. You benefit from complex order types, such as buy, sell, and trailing stops. Account analysis is at your disposal. This financial trading software also includes charts from MultiCharts, which enable advanced and sophisticated studies and display styles. Plus you get watch lists, news feeds and economic analysis. Accessing historical and live exchange rates is also simple.

On the downside, the platform does not have an ultra-modern look and some functions are uncomfortable to use. Instead of opening the news, forums and economic analysis on the platform, they open as web pages in separate browsers. Again, you open Oanda’s order book outside the app. All this can prevent a smooth trading experience. Speed tests show the server times and execution rates are industry standard.

The bottom line: the FxTrade platform caters to the needs of traders of all experience levels. You have all the tools needed to trade just a few clicks away from you, not to mention quite a few useful additional features.

FxTrade API Libraries

A subscription to Oanda also means you can explore automated trading. API python tutorials can be found online to help you get the most out of your API tools. Automated trading allows you to execute many more trades than you could ever do manually. It also means that you can be active in a number of markets at once, from gold and oil to binary options and bitcoin CFDs.

Notifications can be created when you enter and exit positions and your criteria can be pre-programmed using Algo labs. This gives you more time to download historical data, analyze tick data and design effective strategies.

For experienced traders and technophiles, the FxTrade API libraries can also help to do the following:

- Access current and historical market data

- Stop-loss, take-profit or entry orders

- Access to Trading Transactions

- Risk-free testing

- Trade Requests

MetaTrader 4

If Oanda’s desktop platform doesn’t appeal to you, you can download the MetaTrader 4 (MT4). In this review, it was found that the industry standard includes advanced mapping, watch lists and automation of trading via an ‘expert advisor’ (EA) plugin. You can also save layouts and map profiles. Additionally, you can set exchange rates, as well as live and monthly exchange rates from within the platform.

On the downside, creating or modifying EAs can be challenging. This is especially true for new traders who are unfamiliar with the unique programming language. While the audible alerts can be annoying, there are options for customization, not to mention a mute button, so we can let the downside slide.

There are also several other fantastic trading tools available at Oanda:

- MotiveWave – This professional charting and technical analysis platform offers more than 250 built-in studies / indicators and 30 built-in trading strategies. This high-performance and easy-to-use software is a powerful weapon to have in your trading arsenal.

- Oanda Market Reports – This tool is powered by Autochartist and provides a brief summary of the markets. An email is actually sent to traders before they start analyzing the coming day. Market reports provide a technical outlook for the forex markets for the next 48 hours.

Setting up a forex order book, indicators and potential strategy is also quick and easy. For those who want to hedge, it is not prohibited. You can view both long and short positions for the same product on the MT4 platform.

Note that traders will also find additional platforms available in the Oanda marketplace. This includes third parties, plus algorithmic trading platforms, such as the Seer trading system.

Note Oanda does not offer Metatrader 5 (MT5).

Mobile Apps

If you’re often on the go, entering and exiting positions from your phone or tablet can be extremely useful. Those looking for an Oanda mobile and iPad review will be impressed with the features of the FxTrade mobile trading platform. Not to mention the integration with a range of devices, from iPhones to Windows Phone 8.

Once you have the internet login, you can download historical quotes, argue against forward rates and speculate on the FTSE 100 or Nasdaq, for example. The platform is also simple to navigate and the sleek design makes for a stress-free experience. There is access to Oanda’s trading tools, distributed history, account analysis, as well as complex order types.You retain the ability to trade directly from charts, and you can also take advantage of charts with indicators and price overlays. You also have the option to customize display styles to find a format that compliments your trading style. As an added bonus, the news, economic calendars and financial announcements are easily accessible from within the app. This makes measuring the market sentiment simple.

There is regular maintenance to ensure that instrument lists are up to date. It also means that any problems and errors are fixed quickly.

Overall, their mobile offering provides a hassle-free transition from the desktop app.

Methods of payment

It is understandable that an increasing number of day traders are looking for direct deposit and withdrawal systems. You can make deposits and withdrawals to your Oanda account using one of the following:

- PayPal

- Bank transfer

- Credit and debit cards

Their website guides you through the process and their customer service should be able to help with withdrawal issues.

Depending on your location, there are other options available as well. Those in China can use China UnionPay and Bpay for example.

So it’s worth checking out their website to see what works where you are. It is worth noting that there may be withdrawal charges. It can be as much as 20 to 35 euros if you opt for a bank transfer. Having said that, you do get one monthly withdrawal from the card at no cost.

Overall, customer reviews of Oanda have shown that merchants are satisfied with the current money transfer mechanisms.

Account Types

Oanda offers a single standard account that requires no minimum deposit. Unfortunately, high volume traders with deep pockets may be disappointed by the lack of additional benefits that some brokers offer traders with significant capital. However, this means that everyone benefits from over seventy currency and precious metal pairs, plus trades of any size.

Demo account

The reviews of the Oanda demo account quickly give an impressive advantage for the Oanda account. Although many forex brokers offer a hands-on download for a limited period, Oanda’s FxTrade demo account is available as long as a trader needs to hone his strategy and build his confidence.

Once you have your demo login details, you have almost the same functionality as live account holders. Their practice account, funded with simulated money, is the ideal way to familiarize yourself with market conditions and test drive Oanda as a potential broker.

Once you’ve grown confident with volume indicators, currency heat charts and backtesting, you can easily upgrade to a live account.

Additional features

If you ask what about this review separates Oanda from the rest, then their extensive range of research and trading tools may be just the job. Their offering surpasses many retail platforms.

For example, Oanda’s academy offers the following:

- Webinars – These online videos cover a wide range of topics, from ‘Getting Started’ to more advanced topics, such as ‘Fibonacci Retracements and Clusters: An Advanced Look at Trend Formation.’

- Interviews – learn from experienced traders as they discuss a variety of topics from trading plans to strategy.

- Articles – These detailed articles appeal to traders of all experience levels.

- Tutorials – manuals can help users with a whole range of topics, including how to trade bitcoin, read data feeds and identify correlations. In addition, you can learn how to start scaling and compare recent live spreads. All of these can help increase your trading day salary.

In addition, Oanda has made accessing historical average exchange rates simple. Viewing open and long-short position ratios is also quick and easy. Furthermore, monthly and annual averages, plus historical classic interest rates can be found. All of this can make conducting in-depth research a hassle-free process.

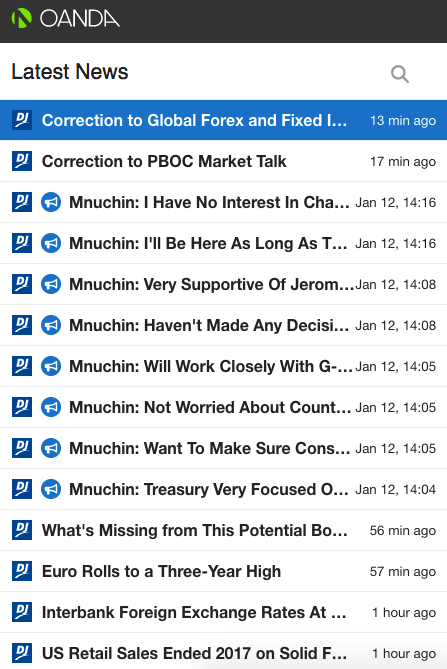

You can also benefit from news reports from a variety of sources about Oanda. These include MarketPulse, 4Cast, plus the Dow Jones FX Select, where you’ll find breaking news, trend analysis and policy commentary. In addition, there is easy access to margin and leverage calculators to help you determine potential profit and loss.

The only downside is that, with so many sources available, it can be a bit of a minefield to track them down.

Safety and Security

With an increase in cybercrime, digital security became an important source of broker reviews in 2017. Is Oanda a reliable broker? Fortunately, your personal data and trading activity are kept safe. This is done using high-tech advanced coding technology.

Oanda Ordinance

In recent years, too many day traders are unscrupulous brokers. It is all the more important to choose a licensed and regulated broker. Oanda’s proactive approach to regulation should bring peace of mind to customers.

After receiving a number of international awards, it is no surprise to hear that customer reviews are satisfied with the standard of regulatory oversight. Oanda is regulated in the following countries:

- US – CFTC (Commodity Futures Trading Commission)

- Canada – Investment Industry Regulatory Organization (IIROC)

- United Kingdom – Financial Conduct Authority (FCA)

- Australia – Australian Securities and Investments Commission (ASIC)

- Singapore – Monetary Authority of Singapore (MAS)

- Japan – Financial Services Agency (FSA)

It is also worth underlining that the extent of account protection in case of default depends on where you have your account, despite widespread regulatory oversight.

Advantages

This Oanda review found the following key benefits:

- Product Diversity – As a day trader, a range of products can mean greater opportunities. With Oanda you get access to 71 currency pairs, 16 CFDs for stock indices, 23 CFDs for metals, 8 CFDs for commodities and 6 CFDs for bonds.

- Applications – You can use Oanda’s own desktop software and platforms such as MetaTrader 4. Developers also work hard to implement updates regularly.

- Direct Chart Trading – Traders can enter and close positions directly from a chart. You will find this feature in both Oanda’s and MetaTrader 4 trading platforms.

- No minimum account size – this allows you to open accounts as small as , making them ideal for testing and developing intraday strategies.admin2023-02-11T21:46:11+00:00

- Regulation – As detailed above, Oanda impresses with regulatory oversight by a number of institutions around the world. This obliges Oanda to adhere to rules and regulations designed to protect you, the merchant. This should help reduce concerns about fraud and scams.

- Demo Account – You get a long free trial and it’s easy to download the MetaTrader 4 demo account. You can then open positions and keep your head around average exchange rates. You can also practice with guaranteed stop losses and much more.

For all these reasons, Oanda is widely regarded as one of the 100 best traders.

Disadvantages

Despite the many advantages, there are also some Oanda negatives that are highlighted in this review:

- Missing Tools – Oanda is effective in facilitating the tools they offer. However, if you are looking for cryptocurrencies and single stock CFD trading, you will be disappointed.

- Limited additional protection – Although Oanda does meet the regulatory standards, extra slide and spill protection can benefit the prospective day traders, especially in volatile markets. In addition, more can be done regarding the protection of negative balance.

- Slow customer service – In a business where time is money, the sometimes slow customer service of Oanda can hinder and frustrate many active traders.

- Unorganized Resources – On the plus side, Oanda offers a multitude of educational and trading resources, from webinars to news sources. However, these sources are somewhat disorganized and are only available after external web pages are launched. This may slow down your trading experience.

- ECN – Oanda is not an ECN broker, it is a market maker and some people believe that you find lower spreads with ECN brokers.

Oanda trading hours

Oanda’s trading hours coincide with many of the global financial markets. Trading is available from approximately 17:00 on a Sunday until 17:00 on a Friday UTC – 5.

With that said, Oanda’s hours of operation will vary depending on the department where you hold an account. Traders in Asia Pacific can relax knowing that all the key markets they want to access are open for business on their Oanda trading platform.

Contact and customer service

In day trading, every second is money. This means that every platform error and account problem can cut into your profits. Therefore, it is essential to have fast and effective customer service. Fortunately, Oanda’s brand overviews are quick to offer 24/7, multilingual support.

Apart from holiday working hours, you can contact Oanda’s customer service team at all times. Alternatively, live online chat and telephone support are also available during trading hours. Consult the official website for their contact number in your location.

You can get support in the following languages:

- English

- German

- Spanish

- Italian

- French

- Portuguese

- Russian

It is also worth emphasizing; some negative customer reviews of Oanda have pointed out that customer service response times can be slow. However, hotline staff remain polite and helpful and try to use their support website and archives to fully answer your questions.

Overall, users can trade with confidence because effective support is available regardless of location and time zone.

Verdict

Is Oanda a good forex broker? Well, they get great ratings and reviews, and it’s not too hard to see why. They offer a simple setup, competitive pricing, a range of product offerings, not to mention advanced trading platforms. So, even if you compare Oanda against FXCM and other well-known brokers, Oanda still consistently impresses.

However, there is definitely room for improvement in terms of customer service. Dealers who prioritize fast and reliable support may want to look elsewhere.

However, the Oanda review found the business to be an attractive proposition for customers from around the world.

Accepted countries

Oanda accepts merchants from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries. Merchants cannot use Oanda from Belgium, France, Netherlands, Cyprus, United States.