All Forex traders strive to set up their own profitable strategies. Well, today is your lucky day! We are willing to share with you the best ADX strategy built by a professional trader. Our team at Trading Strategy Guides firmly believes that the easiest way to become a profitable trader is to imitate the behavior of professional traders.

We’ve talked a lot about trend trading strategies. You can find many proofs here: MACD Trend Following Strategy – Easy to Learn Trading Strategy, here: How to Profit from Trading Pullbacks and here: Swing Trading Strategies That Work.

However, we have not covered how to measure the strength of the trend within any possible timeframe. You can only measure the strength of the trend by using a special trading indicator. For example, the ADX, which is an abbreviation for an Average Directional Index.

Detecting a strong directional move is the most important skill for all traders. No matter what type of trader you are, after entering a position you need a strong directional move. To make a profit, the move must be in the direction of your trade.

The ADX indicator trading rules can help you achieve your financial goals.

Before moving forward, we need to determine which technical indicator we need for the best ADX strategy. We will define the rules for trading ADX indicators. Also read the hidden secrets of moving average for more information.

ADX indicators for futures

The principles of the average direction index can be applied to almost all tradable assets, including stocks, exchange-traded funds, mutual funds and futures contracts. ADX has become extremely useful in futures markets for many reasons:

- With a standard range of 14 measures, ADX provides a ‘bigger picture’ than many other technical indicators.

- ADX is time adjusted, meaning that the latest data carries extra weight.

- ADX helps you identify the strength of a trend, which will be useful for any contract executed in the near future.

- ADX makes it very easy to compare mutually exclusive futures at the same time.

Futures traders enjoy using ADX as a metric because it provides the perfect blend of past and present time data and predictability of the future. If you are successfully buying futures, you will need to identify which potential contracts are mispriced in the status quo. Using regular ADX readings for futures contracts makes this possible.

Using ADX readings for major indices (such as the DJIA, S&P 500, and others) can also help determine whether the general market is experiencing bearish or bearish conditions.

ADX indicator trading rules

Before we move on to the trading rules for ADX indicators, let’s define what the ADX indicator is and how you can benefit from it.

The ADX indicator simply measures the strength of a trend and whether we are in a trading or non-trading period. In other words, the ADX is a trend strength indicator. This method of technical analysis is used to identify the emergence of strong downtrends and buy signals.

We need to be very careful about how we read and interpret the ADX indicator. It is not a bullish and bearish indicator. ADX’s moving average only measures the strength of the trend.

So, if the price goes UP, and the ADX indicator is also going UP, then we have the case for a strong bullish case.

The same applies if the price goes NED and the ADX indicator goes up. Then we have the case for a strong bearish case.

The first ADX indicator rule states that a reading below 25 indicates a period of untraded or fluctuating market. The second ADX indicator trading rule states that if the ADX is above 25, it is sufficient to indicate a strong bullish / bearish trend.

Remember, that the ADX indicator does not give you any information about the direction of the market. It only gives you information about the strength of a trend.

ADX Indicator Settings

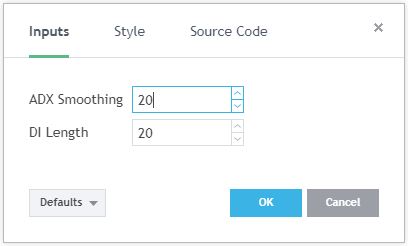

The ADX indicator uses a smooth moving average in its calculation. We find that the best ADX indicator settings are 14 periods. With our ADX indicator settings you have more accurate signals and it will help you to trade earlier.

The ADX indicator works best when used in combination with other technical indicators.

The best ADX strategy also includes the RSI indicator to time the time. The ADX indicator can only help us measure the intensity of the trend. We must have an RSI indicator for entry signals.

The RSI uses a 20-period setting, which is the same as the ADX indicator settings.

Finally, you should have chart setup at the bottom of the ADX and RSI indicator. It should be the same as in the figure below.

Let’s see how you can trade effectively with the best ADX strategy. You learn how to profit by applying the ADX indicator trading rules.

The Best ADX Strategy

The ADX indicator trading rules will ensure that you only trade when there is a strong trend on the 5 minute chart or the daily chart. In this regard, the best ADX strategy is a universal strategy that performs the same regardless of the time frame used.

Going forward, we will look for sales opportunities.

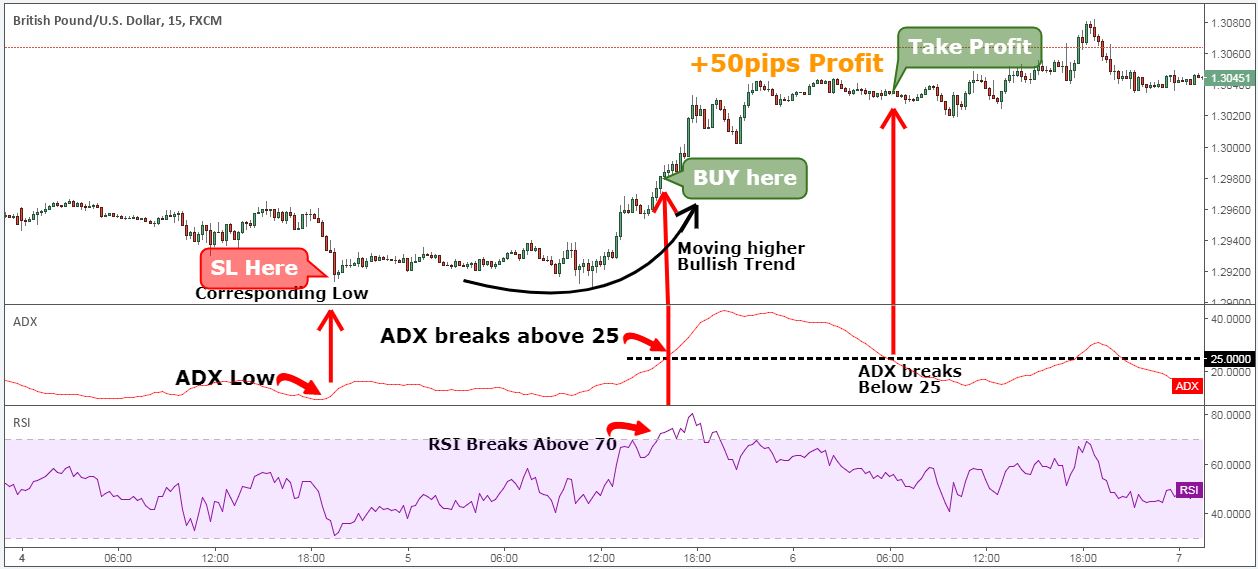

Step #1: Wait until the ADX indicator shows a reading above 25.

Before we even check whether the market is rising or falling, we should first wait for the ADX indicator to show a reading above 25. Based on the trading rules of the ADX indicator, a reading above 25 indicates a strong trend and the probability of a trend developing.

We all know that the trend is our friend, but without the right force behind the trend, the newly formed trend can disappear quickly.

To determine the direction of the trend, we also need to look at the actual price action. This brings us to the next step of the best ADX strategy.

Step #2: Use the last 50 candlesticks to determine the trend. Look for price for a strong trend.

Regardless of your time frame, we need a practical way to determine the direction of the trend.

By using a sample size of 50 candlesticks to determine the trend, we ensure that we are currently trading. We like to keep things simple, so if the price is lower during the last 50 candlesticks, we are in a strong trend.

It is now time to focus on the catalyst that will activate our sell signal for the best ADX strategy.

Step 3: Sell if the RSI indicator breaks and shows a reading below 30.

For our entry signal we use the RSI indicator which uses the same settings as the ADX indicator settings. Normally, the RSI reading below 30 indicates an oversold market and a reversal zone. However, smart trading means looking beyond what the textbook says.

In a strong trend as defined by the ADX indicator, this is exactly what we want to see. We want more sellers to come into the market.

So we want to sell when the RSI indicator breaks and shows a reading below 30.

The next important thing we need to determine is where to place your protective stop loss.

See below…

Step 4: Protective stop loss should be placed on the last ADX high.

In order to determine the stop-loss location for the best ADX strategy, first identify the point where the ADX reached the last high before our entry. Second, find the corresponding high on the price of the ADX high, and there it is your SL level.

Last but not least, the best ADX strategy is also a place where we need to take profit, which brings us to the last step of this unique strategy.

Step 5: Take profit when the ADX indicator breaks back below 25.

The best ADX strategy is aimed at obtaining only the profits, which arise from the presence of a strong trend. Once the prospects for a strong trend disappear, we look for profit and wait for another trading opportunity.

To achieve this, we take profits as soon as the ADX indicator breaks back below 25.

An ADX reading below 25 indicates that the prevailing trend is strengthening.

Note ** The above was an example of a SELL trade using the rules of the ADX indicator. Use the same rules, but in reverse, for a BUY trade. In the figure below you see an actual BUY trade example.

Look:

Conclusion – ADX indicator

The best ADX strategy gives us a lot of useful information because a lot of the time we as traders don’t want to get into something that isn’t moving anywhere and isn’t trending in a strong way. By applying the ADX indicator trading rules, you can take advantage of the strength of the trend and get quick profits in cash. The main point is that the best profits are obtained by catching strong trends and the best ADX strategy can help you achieve your trading goals.

You can also read about the Trader Profile Quiz.

The Best ADX Strategy is similar to the Best Momentum Trading Strategy for Fast Profits because both strategies seek to take advantage of the strength of the trend.

Thanks for reading!