In this article, we discuss the most important things you need to know about the best Forex indicators. These indicators will function as essential buy and sell signals that can be used in any trading strategy. Our ultimate guide to technical indicators will explore what the best forex volume indicators and forex trend indicators are. We will start with the basics and then reveal the best and most important forex indicators for traders. In addition, we are going to show how to develop your forex strategies based on indicators.

If this is your first time on our site, our team at Trading Strategy Guides welcomes you. Be sure to click the subscribe button so you get your free trading strategy delivered straight to your inbox every week. Our tested trading strategies have helped traders to exploit the forex market and various others.

It doesn’t matter what type of trader you are (day trader, scalper, swing trader or trend trader), you need a Forex trend to be able to make a profit. The currency market must move up or down after placing your order, otherwise you cannot make a profit. Our forex trend indicator allows you to indicate whether prices are likely to rise or fall.

Technical indicators make it easy for you to identify current price trends and predict where prices will move in the future. By developing the best strategy for forex indicators, you can increase the amount you earn every trading day.

If you are new to the forex market, check out our Forex Trading for Beginners guide which covers all the information you need on how to start FX trading.

Let’s start by defining what a Forex indicator is

INDEX

1 Forex Indicators Explained 2 How Many Types of Forex Indicators Are There?

2.1 Leading indicators

2.2 Attention Indicators

2.3 Indicators confirmed

3 How to use Forex trend indicators

4 How to Use the Best Indicators for Forex Volume 5 Indicators for Forex Breakout Strategy

5.1 Final Words – Forex Trend Indicators

Forex indicators explained

Forex indicators are simply tools used in the technical analysis process to predict future price movement. A technical indicator uses a strict mathematical formula based on historical prices and/or volume and displays the results in the form of a visual representation, either at the top of the price or at the bottom of your window.

If used correctly, technical indicators can add a new dimension to understanding how price moves. The best trading strategies will often rely on various technical indicators. It is common knowledge that many traders, especially novice traders, use technical indicators as their primary tool to analyze the price movement.

These technical indicators are basically used to support your price analysis. Most Forex trading platforms should have a standard set of the most popular technical indicators. To find an fx platform, we recommend the forex trading platforms section of Compare Forex Brokers.

There is also a hidden danger that you should be aware of that we call: Analysis Paralysis. In other words, you should be careful not to fall into the trap of using too many technical indicators which can ultimately affect your ability to properly analyze the market price.

The FX indicators are very useful for analyzing a price chart. If you don’t know how to start using FX indicators, check out: How to apply technical analysis – step by step guide. Now let’s see what are the different types of Forex technical indicators and how to to use it correctly.

How many types of Forex indicators are there? There are numerous technical indicators available to choose from. In technical analysis, most Forex indicators fall into one of three categories as follows:

- Leading Forex Indicators (Parabolic SAR, RSI, Stochastic)

- Laughing Forex Indicators (Moving Averages)

- Confirmation of Forex indicators (on balance volume)

You need to take the necessary time and learn the meaning of each technical indicator. No indicator will give you a 100% win rate, so don’t be the one chasing fairy tales. This is why many traders use multiple indicators. Taking a closer look at the market will help you succeed as a trader. What is the best technical indicator in forex? Here is a method to improve our chart reading skills and learn which FX indicators to use and how to use them. to combine: Best combination of technical indicators – methods for market maker .In addition, the FX technical indicators can be arranged according to the type of data we extract from them. We can identify four types of indicators to understand the market:

- Forex Momentum Indicators (RSI, Stochastic, CCI, Williams %R)

- Forex trend indicators (moving averages, MACD, parabolic SAR)

- Forex Volatility Indicators (Bollinger Bands, Envelopes, ATR)

- Forex sentiment indicators or FX volume indicators (OBV, Chaikin Money Flow)

Leading indicators

A leading technical indicator gives early warnings and trading signals of where the price is going to move. These indicators can determine the direction to trade before the new trend has even started.

It sounds too good to be true, and you are right to be skeptical. If leading indicators could pre-sign trades, before the trend started, we would all be very rich by now, which they are not. The downside is that leading indicators are notorious for their many false signals. This means that they mislead you in the wrong direction.

In the example above we have the EUR/USD with the RSI indicator showing overbought conditions in the market. Despite the over cost of the RSI, the EUR/USD continued to decline as the prevailing and the dominant trend continues to rise.

A novice trader would probably have sold as soon as the RSI entered excessive territory, which would have caused him to lose money. With experience, the trader will learn to correct their entries and exits with a sense of precision. Note * Technical indicators are not perfect, but if used correctly for their strength and in the context of a trend framework, great things are achieved.

Indicators of deterioration

As the name suggests, a trailing technical indicator is delayed from the current market price. The delay is usually caused by the use of larger price data inputs in its calculation. But a lagging indicator can be very useful in measuring the market trend.

The whole idea of using a lagging indicator for trending is that they remove a lot of the market noise inherited by the price and give you a much better idea of the trend. The downside is that a downtrend indicator will only alert you to a trend after the trend has started.

This is not so good because many times it means you are late to the party, and secondly, the later you go in the direction of the trend, the less profit margin will be available to you. In this case, by using a trailing indicator to trade, you miss a good part of the potential profit.

The classic moving average crossover system is a good example of how lagging indicators indicate the change in market sentiment after the new trend has started (see Forex diagram below).

Note * we must keep in mind that most indicators are technical in nature.

Indicators confirmed

A confirming technical indicator can be extremely useful in confirming your price analysis. As the name suggests, confirmation indicators are only used to confirm that the reading of the price action is correct. One of the most popular confirmation indicators is the On Balance Volume – OBV. Volume indicators are incredibly useful.

The way one will use and interpret the OBV readings is quite simple. What drives the trend is buyers and sellers and their aggressiveness, and in this respect, the volume should increase when the market moves in an uptrend or in a downtrend.

In the example below, if for whatever reasons you decided that the uptrend would reverse, then this would confirm your analysis using the OBV indicator. The rise was not fast because buyers are not buying this rise as indicated by the OBV indicator.

Understanding the differences and similarities between the three types of technical indicators will help you better read the information they provide and then decide how to trade. The best trading indicator for you will depend on your trading objectives.

In addition, you can also use functional indicators, for example the Forex bar timer indicator. The candlestick indicator simply counts down the time until the next candle opens. It is simply a functional tool used by many professional traders to determine the price chart.

Now let’s see what is the most important Forex indicator of all time.

How to use Forex Trend Indicators

The FX Trend Indicator 200 Day Moving Average is considered the best trend indicator out there.

For example, if you looked at a 200 day moving average. What you will draw on your chart is a pivot that looks at the last 200 closing prices and then determines the average price. This way, you can eliminate a lot of the noise that is inherited in your price chart and give you a much simpler view of what is going on in the market.

A moving average is really an easy way to identify the trend and give it some definition. This should give you the answer as to whether you are in an uptrend or a downtrend and how strong the trend is. Because a moving average can measure the direction of the trend, they are also called a trend indicator (see Forex chart below).

The slope of the moving average and where the price is in relation to the MA will determine the direction of the trend.

The second most important technical indicator is the Forex Volume Indicator.

How to use the best indicators for Forex volume

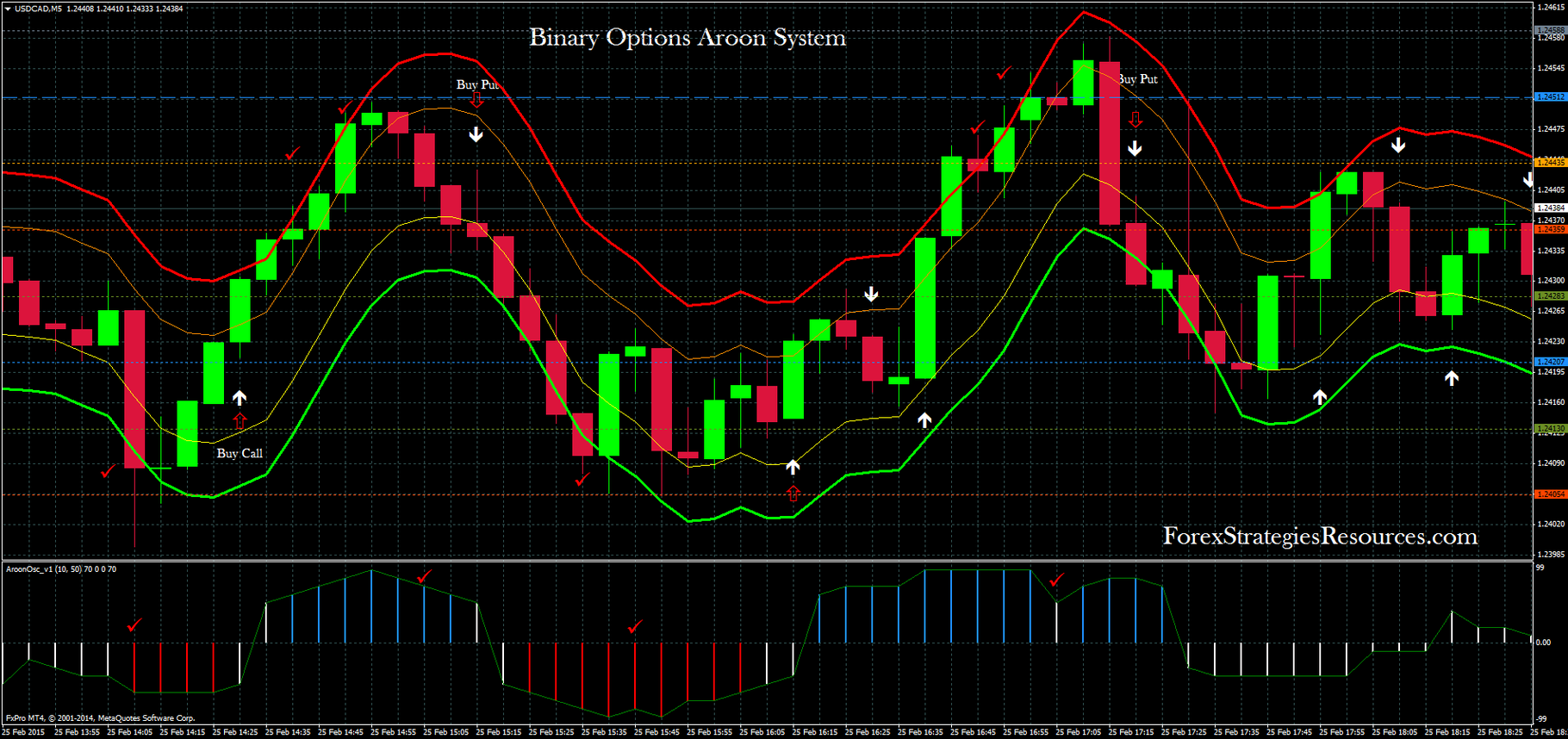

The Forex Volume Indicators are used as a confirmation tool to confirm the trend. Moreover, the volume indicator is so versatile that it can also be used to confirm a Forex breakout. Identifying judgments allows you to trade ahead of the market.

The volume indicators can help us better understand how healthy and safe the trend is. A volume-based indicator is usually displayed at the bottom of your chart, and many of them come in the form of some sort of oscillator. Most oscillators have an upper and lower barrier that usually indicates buying and selling pressure.

Looking for the best strategy for forex volume indicators? Your hunt is over. Check out the FREE volume trading strategy to win 77% of trades for yourself.

We also promised that we will show you what Forex Breakout Strategy Indicators you need to trade Forex Sections.

Indicators for Forex Breakout Strategy

How can you tip the odds in your favor when trading breakouts?

An excerpt is probably the most visible and common card pattern. It also creates excellent opportunities for profit. Most trends appear from a breakdown of consolidation. The high frequency in which a breakout pattern occurs makes the breakout more likely to give false signals. Using a technical indicator to confirm a Forex breakout is extremely important if you want to distinguish between a false breakout and a real breakout.

If you want to learn how to use the forex strategy indicators, see some of the best trading tactics used by professional traders: Breakout Trading Strategy Used by Professional Traders.

What makes a break-up valid is whether the FX rate arises as a result of smart money activity. So, to determine the breakdown, we really need to use a volume indicator to measure the buying and selling activity by professionals.

One volume-based indicator is the VWMA (Volume Weighted Moving Average).

The VWMA is one of the most underrated technical indicators that only professional traders use. VWMA looks like a moving average but is based on volume. It is not just a price based moving average.

Final words – indicators for forex trends

Forex indicators can be extremely useful if you keep them simple, but they can become problematic if they get too complicated. Make sure you understand which forex indicators you choose to use. Certain technical indicators can be very helpful in reading the price action, and more importantly, can help you predict the future price movement. However, before you immerse yourself in the world of Forex technical indicators, remember that price is still the ultimate truth teller of what is really going on behind a chart.

Each indicator has its own strength. On the one hand, Forex trend indicators are more useful in determining the general direction of the market. At the same time, some of the best forex volume indicators can be used more to confirm the strength of the trend. Read here about the best forex strategies.

Thanks for reading!

Feel free to comment below, we all read it and will respond.

Also give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own use! Thank you traders!

In this article, we discuss the most important things you need to know about the best Forex indicators. These indicators will function as essential buy and sell signals that can be used in any trading strategy. Our ultimate guide to technical indicators will examine what the best forex volume indicators and forex trend indicators are. We will start with the basics and then reveal the best and most important forex indicators for traders. In addition, we are going to show how to develop your forex strategies based on indicators.

If this is your first time on our site, our team at Trading Strategy Guides welcomes you. Be sure to click the subscribe button so you get your free trading strategy delivered straight to your inbox every week. Our tested trading strategies have helped traders to exploit the forex market and various others.

It doesn’t matter what type of trader you are (day trader, scalper, swing trader or trend trader), you need a Forex trend to be able to make a profit. The currency market must move up or down after placing your order, otherwise you cannot make a profit. Our forex trend indicator allows you to indicate whether prices are likely to rise or fall.

Technical indicators make it easy for you to identify current price trends and predict where prices will move in the future. By developing the best strategy for forex indicators, you can increase the amount you earn every trading day.

If you are new to the forex market, check out our Forex Trading for Beginners guide which covers all the information you need on how to start FX trading.

Let’s start by defining what a Forex indicator is

INDEX

1 Forex Indicators Explained

2 How many types of Forex indicators are there?

2.1 Leading Indicators

2.2 Attention Indicators

2.3 Indicators confirmed

3 How to Use Forex Trending Indicators

4 How to use the best indicators for Forex volume

5 Forex Breakout Strategy Indicators

5.1 Final Words – Forex Trend Indicators

Forex indicators explained

Forex indicators are simply tools used in the technical analysis process to predict future price movement. A technical indicator uses a strict mathematical formula based on historical prices and/or volume and displays the results in the form of a visual representation, either at the top of the price or at the bottom of your window.

If used correctly, technical indicators can add a new dimension to understanding how price moves. The best trading strategies will often rely on various technical indicators. It is common knowledge that many traders, especially novice traders, use technical indicators as their primary tool to analyze the price movement.

These technical indicators are basically used to support your price analysis. Most Forex trading platforms should have a standard set of the most popular technical indicators. To find an fx platform, we recommend the forex trading platforms section of Compare Forex Brokers.

There is also a hidden danger that you should be aware of that we call: Analysis Paralysis. In other words, you should be careful not to fall into the trap of using too many technical indicators which can ultimately affect your ability to properly analyze the market price.

The FX indicators are very useful for analyzing a price chart.

Now let’s see what are the different types of Forex technical indicators and how to use them correctly.

How many types of Forex indicators are there?

There are numerous technical indicators available to choose from. In technical analysis, most Forex indicators fall into one of three categories as follows:

- Leading Forex Indicators (Parabolic SAR, RSI, Stochastic)

- Laughing Forex Indicators (Moving Averages)

- Confirmation of Forex indicators (on balance volume)

You need to take the necessary time and learn the meaning of each technical indicator. No indicator will give you a 100% win rate, so don’t be the one chasing fairy tales. This is why many traders use multiple indicators. Taking a closer look at the market will help you succeed as a trader.

What is the best technical indicator in forex?

Here is a method to improve our chart reading skills and learn which FX indicators to use and how to combine them: Best combination of technical indicators – methods for market maker .

Moreover, the FX technical indicators can be arranged according to the type of data we extract from them. We can identify four types of indicators to understand the market:

- Forex Momentum Indicators (RSI, Stochastic, CCI, Williams %R)

- Forex trend indicators (moving averages, MACD, parabolic SAR)

- Forex Volatility Indicators (Bollinger Bands, Envelopes, ATR)

- Forex sentiment indicators or FX volume indicators (OBV, Chaikin Money Flow)

- Leading indicators

A leading technical indicator gives early warnings and trading signals of where the price is going to move. These indicators can determine the direction to trade before the new trend has even started.

It sounds too good to be true, and you’re right to be skeptical.

If leading indicators could signal trades in advance, before the trend started, we would all be very rich by now, which is not the case. The downside is that leading indicators are notorious for their many false signals.

This means that they are misleading you in the wrong direction.

In the example above we have the EUR/USD with the RSI indicator showing overbought conditions in the market. Despite the over cost of the RSI, the EUR/USD continued to decline as the prevailing and the dominant trend continues to rise. A novice trader would probably have sold as soon as the RSI entered excessive territory, which would have caused him to lose money. With experience, the trader will learn to correct their entries and exits with a sense of precision.

Note * Technical indicators are not perfect, but if used correctly for their strength and in the context of a trend framework, great things can be achieved.

Indicators of deterioration

As the name suggests, a trailing technical indicator is delayed from the current market price. The delay is usually caused by the use of larger price data inputs in its calculation. But a lagging indicator can be very useful in measuring the market trend.

The whole idea of using a lagging indicator for trending is that they remove a lot of the market noise inherited by the price and give you a much better idea of the trend. The downside is that a downtrend indicator will only alert you to a trend after the trend has started.

This is not so good because many times it means you are late to the party, and secondly, the later you go in the direction of the trend, the less profit margin will be available to you. In this case, by using a trailing indicator to trade, you miss a good part of the potential profit.

The classic moving average crossover system is a good example of how lagging indicators indicate the change in market sentiment after the new trend has started (see Forex diagram below).

Indicators confirmed

A confirming technical indicator can be extremely useful in confirming your price analysis. As the name suggests, confirmation indicators are only used to confirm that the reading of the price action is correct. One of the most popular confirmation indicators is the On Balance Volume – OBV. Volume indicators are incredibly useful.

The way one will use and interpret the OBV readings is quite simple. What drives the trend is buyers and sellers and their aggressiveness, and in this respect, the volume should increase when the market moves in an uptrend or in a downtrend.

In the example below, if for whatever reasons you decided that the uptrend would reverse, then this would confirm your analysis using the OBV indicator. The rise was not fast because buyers are not buying this rise as indicated by the OBV indicator.

Understanding the differences and similarities between the three types of technical indicators will help you better read the information they provide and then decide how to trade. The best trading indicator for you will depend on your trading objectives.

In addition, you can also use functional indicators, for example the Forex bar timer indicator. The candlestick indicator simply counts down the time until the next candle opens. It is simply a functional tool used by many professional traders to determine the price chart.

Now let’s see what is the most important Forex indicator of all time.

How to use Forex Trend Indicators

The FX Trend Indicator 200 Day Moving Average is considered the best trend indicator out there.

For example, if you looked at a 200 day moving average. What you will draw on your chart is a pivot that looks at the last 200 closing prices and then determines the average price. This way, you can eliminate a lot of the noise that is inherited in your price chart and give you a much simpler view of what is going on in the market.

A moving average is really an easy way to identify the trend and give it some definition. This should give you the answer as to whether you are in an uptrend or a downtrend and how strong the trend is. Because a moving average can measure the direction of the trend, they are also called a trend indicator (see Forex chart below).

The slope of the moving average and where the price is in relation to the MA will determine the direction of the trend.

The second most important technical indicator is the Forex Volume Indicator.

How to use the best indicators for Forex volume

The Forex Volume Indicators are used as a confirmation tool to confirm the trend. Moreover, the volume indicator is so versatile that it can also be used to confirm a Forex breakout. Identifying judgments allows you to trade ahead of the market.

The volume indicators can help us better understand how healthy and safe the trend is. A volume-based indicator is usually displayed at the bottom of your chart, and many of them come in the form of some sort of oscillator. Most oscillators have an upper and lower barrier that usually indicates buying and selling pressure.

Looking for the best strategy for forex volume indicators? Your hunt is over. Check out the FREE volume trading strategy to win 77% of trades for yourself.

We also promised that we will show you what Forex Breakout Strategy Indicators you need to trade Forex Sections.

Indicators for Forex Breakout Strategy

How can you tip the odds in your favor when trading breakouts?

An excerpt is probably the most visible and common card pattern. It also creates excellent opportunities for profit. Most trends appear from a breakdown of consolidation. The high frequency in which a breakout pattern occurs makes the breakout more likely to give false signals. Using a technical indicator to confirm a Forex breakout is extremely important if you want to distinguish between a false breakout and a real breakout.

If you want to learn how to use the forex strategy indicators, see some of the best trading tactics used by professional traders: Breakout Trading Strategy Used by Professional Traders.

What makes a break-up valid is whether the FX rate arises as a result of smart money activity. So, to determine the breakdown, we really need to use a volume indicator to measure the buying and selling activity by professionals.

One volume-based indicator is the VWMA (Volume Weighted Moving Average).

The VWMA is one of the most underrated technical indicators that only professional traders use. VWMA looks like a moving average but is based on volume. It is not just a price based moving average.

Final words – indicators for forex trends

Forex indicators can be extremely useful if you keep them simple, but they can become problematic if they get too complicated. Make sure you understand which forex indicators you choose to use. Certain technical indicators can be very helpful in reading the price action, and more importantly, can help you predict the future price movement. However, before you immerse yourself in the world of Forex technical indicators, remember that price is still the ultimate truth teller of what is really going on behind a chart.

Each indicator has its own strength. On the one hand, Forex trend indicators are more useful in determining the general direction of the market. At the same time, some of the best forex volume indicators can be used more to confirm the strength of the trend. Read here about the best forex strategies.

Thanks for reading!

Feel free to comment below, we all read it and will respond.

Also give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own use! Thank you traders!