Binary options bonuses can give you extra money to trade, sometimes for free, but more often as an extra percentage of the amount deposited into your account (‘deposit match’ bonus).

Binary options brokers are always eager to attract new traders. One of the most important ways to acquire new uses is to offer bonuses. These can come in many forms, from simple deposit bonuses or risk-free deals to more complicated educational tools and high-tech gadgets. Brokers know how to attract new and existing traders.

Here we list and compare all the bonuses for 2020, and explain the points that ensure that the bonus you get is a real benefit and not a source of frustration. We can look at some of the common bonus types and receive them at the right time. It also explains why some of the pitfalls and all the glitterers are not gold.

Best bonuses for traders in Africa in 2020

What is the Binary Options trading bonus?

Binary option bonuses are broker offers intended to provide traders with extra funds to trade losses if traders go wrong. The offer is usually in the form of a welcome bonus or an entry which is sometimes called. Welcome offers are of course also incentives for new customers to join the broker in question.

For example, it comes in different forms:

- No deposit bonus

- Deposit Match

- Risk free trading

- Educational material

- Hardware or Goods

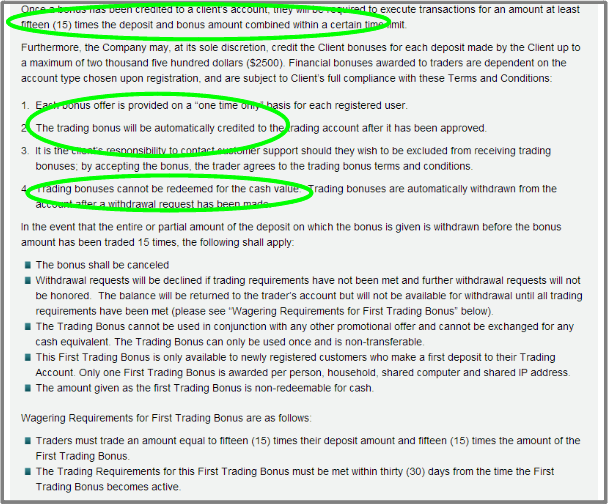

Bonuses always come with terms and conditions. This term is the most important aspect when comparing bonuses. For example, a small ‘no strings attached’ bonus can be much more attractive than a large bonus with very restrictive terms and conditions.

Welcome Bonus

Let us take an example. The most common form of bonus is ‘Deposit Match’. From here, when a new trader opens an account, a bonus is generated on the first deposit. This is usually the rate of deposits. Assuming you have a 50% deposit, this is a bonus deal:

- The merchant makes a deposit of 0

- 50% bonus (in this case 0) is added to your account

If the bonus figure of the deposit match is 100%, the same trader will receive $ 200 bonus funds.

Risk free trade

Risk-free trading is another simple form of bonus. An attraction of risk-free bonuses is that the term is usually less restrictive. Risk-free trading gives traders the opportunity to trade. If it wins, they keep the profit.

Some brokers offer three to five risk-free trades, all of which work the same way. But the more transactions, the more conditions. For example, for bare-bones transactions, brokers are likely to pay cash in prizes. You can withdraw immediately. If a broker offers a more risk-free trade, it must be ‘transferred’ several times before all profits are withdrawn.

This is one of the reasons why terms are important when comparing bonuses. At the end of this page, we take a closer look at risk-free trading and explain why there is always some risk involved.

No deposit bonus

The ‘no deposit’ bonus is exactly what the name suggests. Bonuses will be credited to your account without the first deposit. This is an attractive option for merchants, but it is important to read the terms and conditions described above. Without a deposit, a very high turnover rate is usually required before withdrawing funds, and this requirement must generally be met in a short period of time.

As the terms and conditions get tricky, live accounts with ‘no deposit bonus’ do not work in the same way as demo accounts. The reason is that these bonus funds are likely to be withdrawn less frequently and are not ‘real money’ until certain strict criteria are met.

This type of bonus is also rare. This does not work well for brokers or traders. In recent months we have switched to ‘risk free’ transactions, not deposit bonuses. This allows traders to use a real cash platform, but few transactions involve any financial risk. Brokers now tend to offer risk-free offers or deposit match bonuses.

The best time to claim a bonus

The best time to claim benefits is usually not at the time of the first deposit. For some brokers, the best way to lower the bonus is to open an account with a minimum deposit. After the trading period, then call the broker to negotiate the bonus yourself based on the larger deposit. This is especially effective if the amount to be invested is larger. The bigger the second deposit, the better the bonus condition.

If this seems like too much of a problem, new traders should definitely investigate the possible bonus and see if it works. See if you can comfortably meet your bonus conditions without changing your trading habits. Pay particular attention to the turnover requirements and the time limits that the time limit must meet.

Terms of Use

There are certain issues traders should be aware of when comparing bonuses. All these problems are usually somewhere within a term, so it is important to identify them. Here are some details to watch out for when checking the fine print of the bonus deal you found:

- Withdrawal Limits – Almost all the bonuses include: For example, do you have to meet the turnover requirement and within a certain time? The larger the deposit, the more limited. A 0 bonus, which requires you to spin 20 or more times, means a transaction worth 00.

- Is your deposit closed? – There is a form of bonus that locks the initial deposit and the deposit itself, so nothing can be withdrawn until the turnover requirement is met. Fortunately, these bonuses are rare, but they have huge benefits for traders. It is best to avoid all brokers who use these kinds of terms altogether.

- How is the bonus paid? – Are bonus funds separate from deposits? Then it’s usually better.

- How is the price paid in a risk-free transaction? – Will the returns be paid into the account or added as a bonus fund (its condition is met)

Finding the best offer

As we discussed, finding the ‘best’ bonus for binary options is when you research the terms and conditions. This way you can determine if the bonus suits your trading style. If you do not trade too much and the conditions are not met, a large bonus with limited conditions is not worth it. Small bonuses with few restrictions can welcome trading funds. As for the bonus, the biggest is not always the best.

Finally, a reliable, high-quality broker can easily withdraw the bonus. Some may even cancel the bonus agreement. The broker who paid the bonus may seem timely. If the bonus doesn’t suit you, decline.

Why don’t you want a deposit bonus?

Deposit bonuses are a common feature of today’s binary options brokers, which they use as a lure for new traders to open and fund their accounts. Who doesn’t want free money? But is the problem really free? There are many reasons why a bonus doesn’t seem free and why you don’t accept the bonus.

Deal minimum – All bonuses have a minimum deal. The amount that must be reached before the bonus amount can be withdrawn from the account. The minimum amount is 00 as the original depositand bonus, and if you receive a 50% bonus, the minimum amount is based on 00. The average minimum transaction amount is 20 to 30 times the total account value. We have seen 15 times, 40 times or 50 times higher value of the total account. In other words, an account with a total of 00 must make a total of ,000 in trades before receiving the bonus. I want to trade 1% of my account at a time, so my one account can’t damage even one transaction. The K divided by in a 00 account doing at a time is 1500 trades. Obviously, larger trades can be made to clear the minimum faster, but this can also result in catastrophic losses.

Time limits – not all, but some deposit bonuses have time limits. Usually 30 days, 60 days or 90 days. That is, before the withdrawal, the minimum transaction must be reached before the time limit ends. We don’t want to imply that you can’t turn