Do you know how to trade with the best Fractal trading strategy? This fractal trading strategy will answer all your questions about fractals. You learn how to use this strategy step-by-step to achieve consistent winning trades.

Today we are going to a strategy that deals with the Bill Williams Fractal Indicator / Bill Williams Alligator.

Before we start trading fractals profitably, I want to give you some background information about Bill Williams himself. This will help you understand the importance of these special indicators. Also read about Scaling In and Scaling Out in Forex.

Bill Williams Quick Overview: Bill Williams of Trading Fractals

Mr. Williams developed a unique theory from the combination of the Chaos theory with trading psychology. Along with the effects it has on the market movement. Bill Williams’ vast knowledge of stock, commodity, currency markets has led him to develop many indicators, including fractal trading patterns.

These include the Accelerator / the Accelerator Oscillator, the Alligator, the Tremendous Oscillator, the Fractals, the Gator Oscillator and the Market Facilitation.

Each indicator has a specific value. They are great to deal with if you understand the basic concepts of each.

His market view was that you need to be able to understand the basic market structure in order to trade your money. You need to be aware of the internal parts of the markets, which he calls dimensions.

These dimensions include the following:

- Fractal (the phase space)

- Zones (the phase energy and power combination)

- Momentum (the phase energy)

- Deceleration / acceleration (the phase power)

- Balance line (strange attractions)

I could go on and on about Bill Williams. But the most important thing to note is that his analysis and perspective of the market was different. Some powerful indicators are not outdated. It works very well if you apply the right strategy.

Its indicators are standard on most trading platforms. These indicators will most likely be under his name “Bill Williams” or “Williams” indicators.

Indicators used for the Fractal Blaster trading strategy

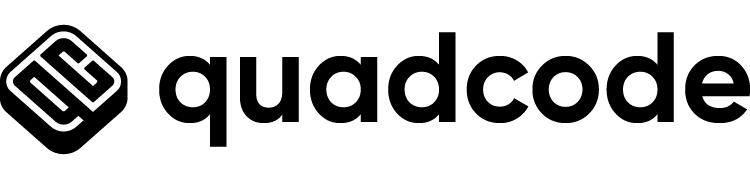

Bill Williams Fractals: How Does Fractal Indicator Work? Well, they are simply arrows above or below the candles on the chart. These fractals are formed when five repeated bars match in a distinct way. You need the fifth bar to discover the highest or lowest layer. We will go into more detail about this indicator and show you how to use the alligator indicator. You can find the fractal indicator on mt4 or other popular trading platforms. You don’t need to run a fractal indicator download because it will already be there.

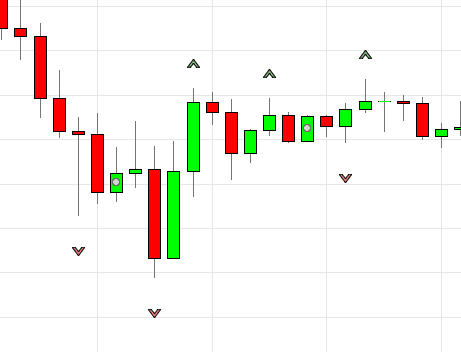

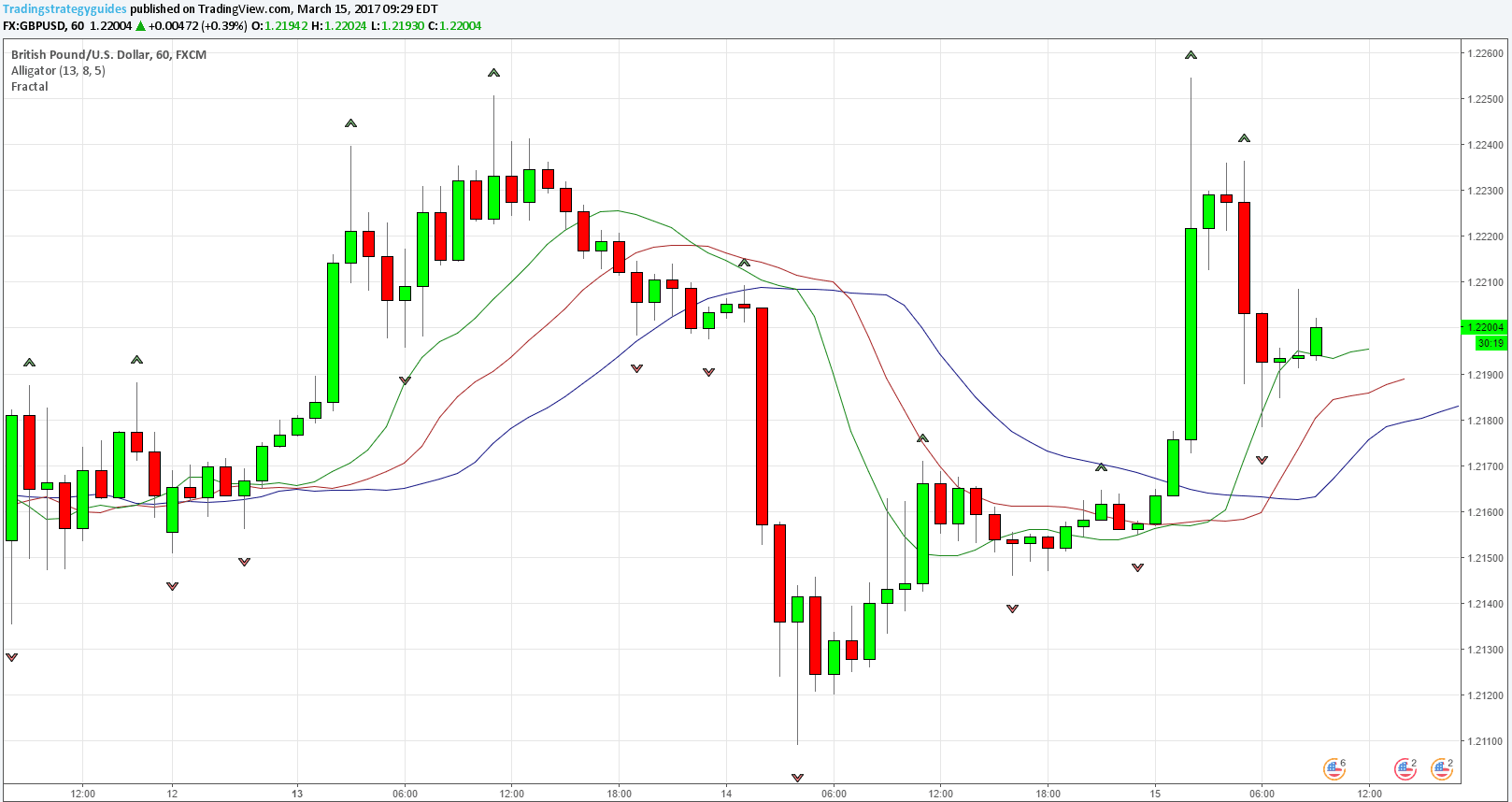

Bill Williams Alligator: How Does the Bill Williams Alligator Indicator Work? This indicator consists of 3 specific moving averages.

The 13-period line is called the jaw (blue).

The 8-period line is called the teeth (red).

The five-period line is called the lips (green).

We will go over this indicator a little more. Each of these rules has a specific name. This is because we will refer to them later in the strategy.

This is what the alligator looks like:

We’ve developed a strategy called the Big Three trading strategy that uses three specific moving averages, if you’d like to explore them later.

These are only two out of a total of 5 indicators developed by Bill Williams.

As you can see above, these are all five of Bill Williams’ powerful indicators that come standard on your trading platform.

I like each of these five indicators, but after extensive research and testing of composition, the alligator and fractal indicator was not only the easiest way to trade his indicators, but is extremely powerful with the right strategy.

Fractal Trading Strategy Steps: The Fractal Trading Techniques

Step #1: Apply both fractal and Bill Williams alligator indicators to your chart

Of course, the first step you want to do is to throw these important indicators on your charts. As I said, this comes standard on every trading platform I’m aware of, so it should be very simple for you to do.

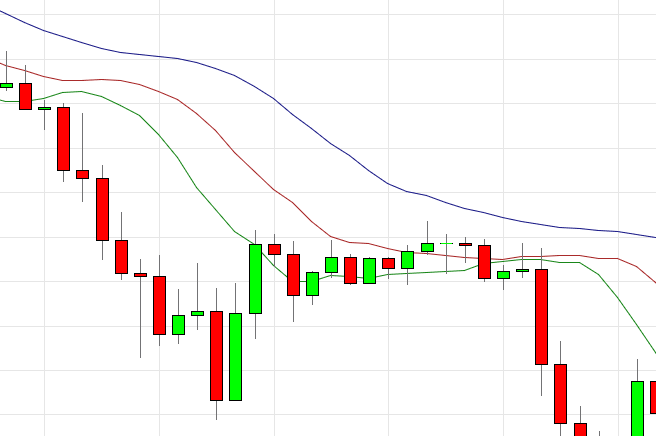

Once you’ve done this, your map will look like this:

Perfect.

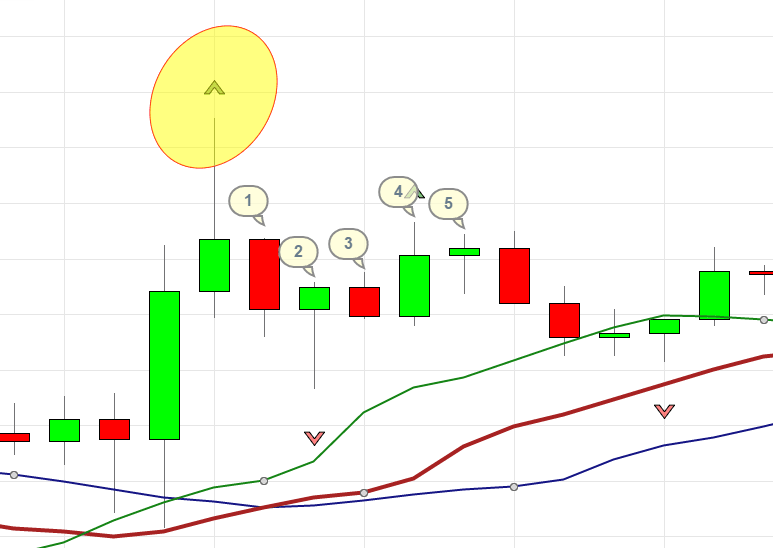

Step #2: Trading Fractals Bill Williams: Identify where the fracture formed (above or below alligator teeth)

Note ** In this example we are using a trade entry, so all these rules apply to a buy entry.

Okay, so let’s see what the fractals are all about.

The fractals indicate a bottom or a top. The basic fractal indicator consists of a minimum of 5 measures. So if you see a fractal here, it could happen that it appears:

- There was a series of at least five consecutive bars, with the highest in the middle and then the two lower heights on either side.

- There has been a reversal streak of at least five consecutive measures when the lowest low is in the middle and the two higher lows are on either side (forming a selling fractal)

- Fractals can only appear with one candle to the right, but be aware that this is an unconfirmed fractal, because the price action can rise through the level. So for a fractal to appear and stay on the chart forever, the trader must wait for 2 candles to the right of the fractal.

- The fractals have a high and a low value. This is indicated by the up or down arrows.

Let’s discuss our example of this strategy for fractal blaster.

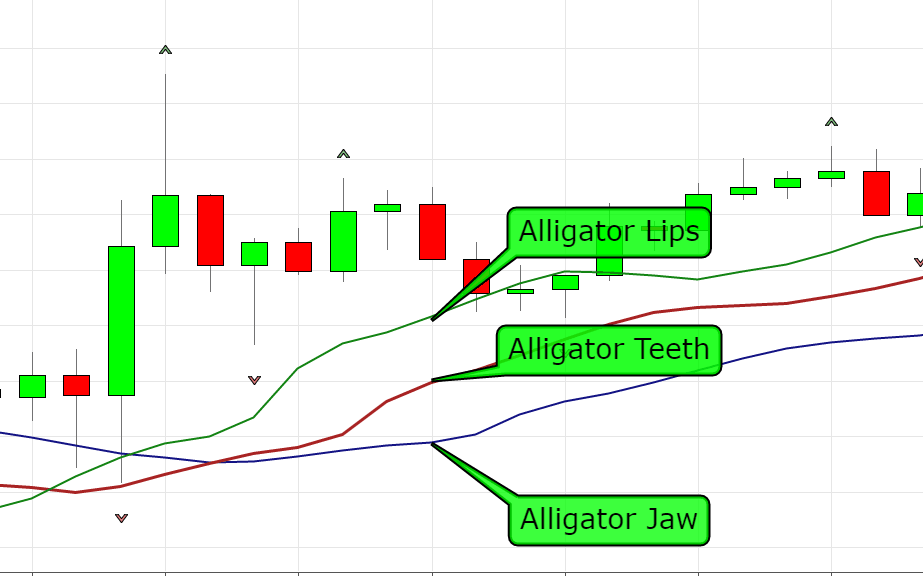

Above are the unique alligator indicator lines on the chart. You now need to be aware of where the fractals are placed on the candles for this strategy regarding this special indicator.

Below is the fractal that we particularly want to notice:

I have drawn a yellow circle on this particular fractal. This fractal on this candle appears above the red line or the (alligator teeth). This is criteria 1 for the Fractal Blaster strategy.

In a BUY trade, the Fractal should appear on a candle above the red line (alligator teeth).

What happens here is that the fractal forms a new high than the previous fractal and therefore makes a fractal appear on the candles.

To go to step 2 (for a BUY trade), the fractal must show up and display above the alligator teeth.

Step #2: The price action must remain above the Alligator Teeth for at least 5 consecutive candles (buy trade)

This is where all the magic happens.

When a fractal like the one above occurs, the price action is still “flat”. This means that there has not been a giant outbreak in the recent time frame. You can also trade with the breakout triangle strategy.

The reason this strategy has to wait for at least five consecutive candles is that this is the time when there is a pullback forming, a reversal could form, or the price action is still consolidating in a flat market. Either one doesn’t sound pleasant if you’re looking for a big upward bullish move to form on the chart.

As you can see, the price action remained quiet and these five candles did not move up or down drastically. This is exactly what you need to see when trading this strategy.

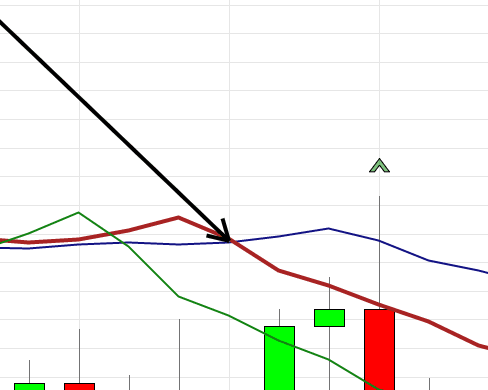

Before we look further into this strategy, here is what will cause the strategy to ‘reset’ and invalidate a future purchase of trade BUY.

1. Reset if: A sell fractal appears below the Alligator Teeth line before opening a position. So:

As you can see if this had happened in our BUY trade example, we would have told ourselves that this trade is invalid and that we should look elsewhere. The reason is that it can cause a long bearish trend, which will not be good if you try to go here.

2. Re-adjust if: either of the two lines of the Alligator indicator crossed to the identified fractal candle in Step # 1. Like this:

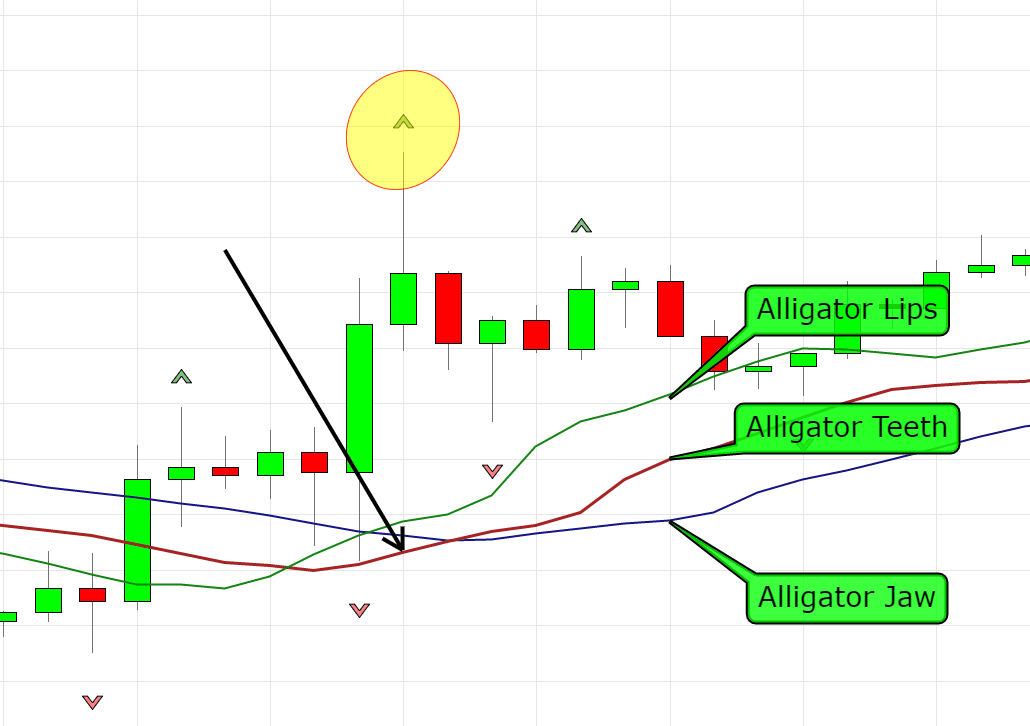

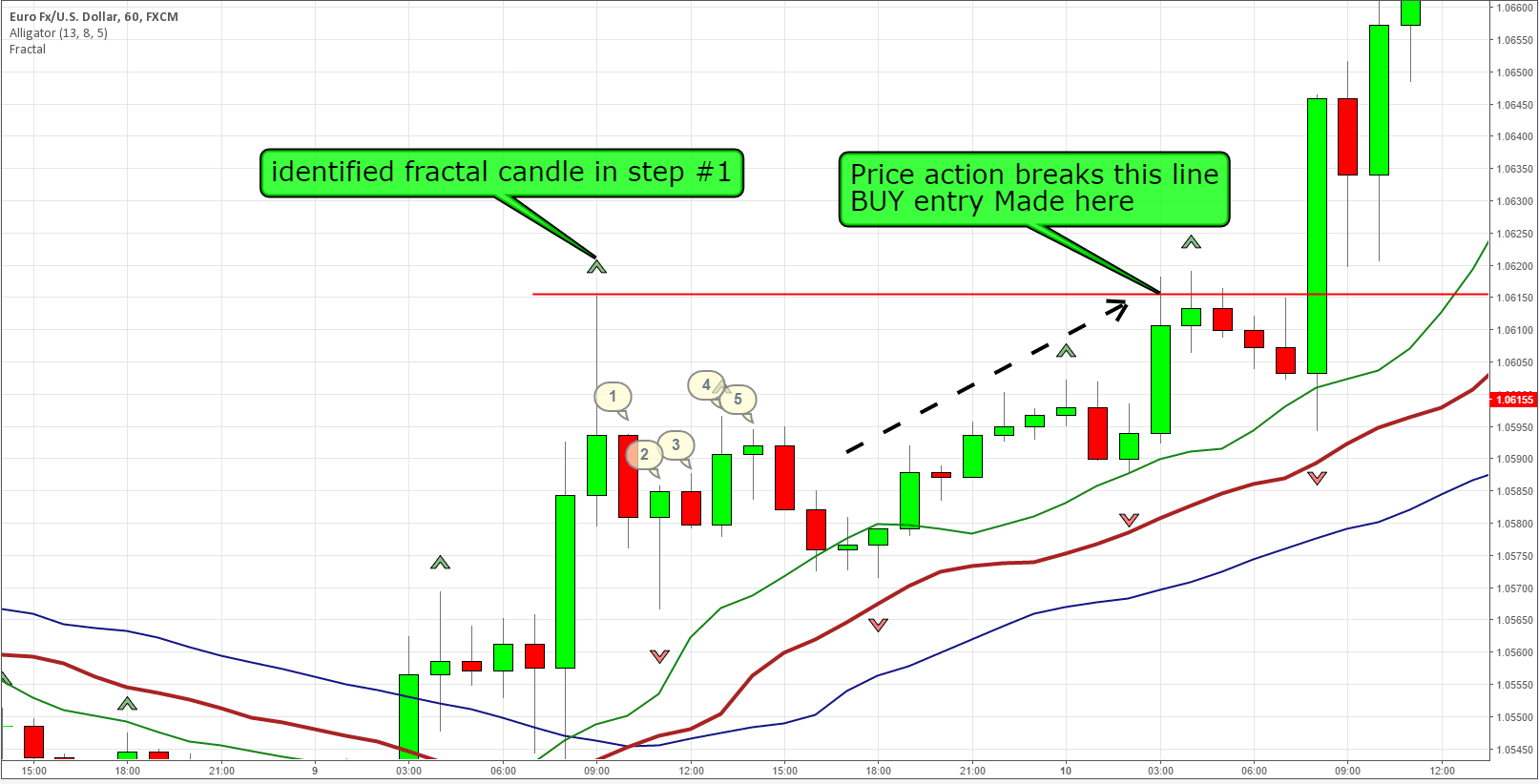

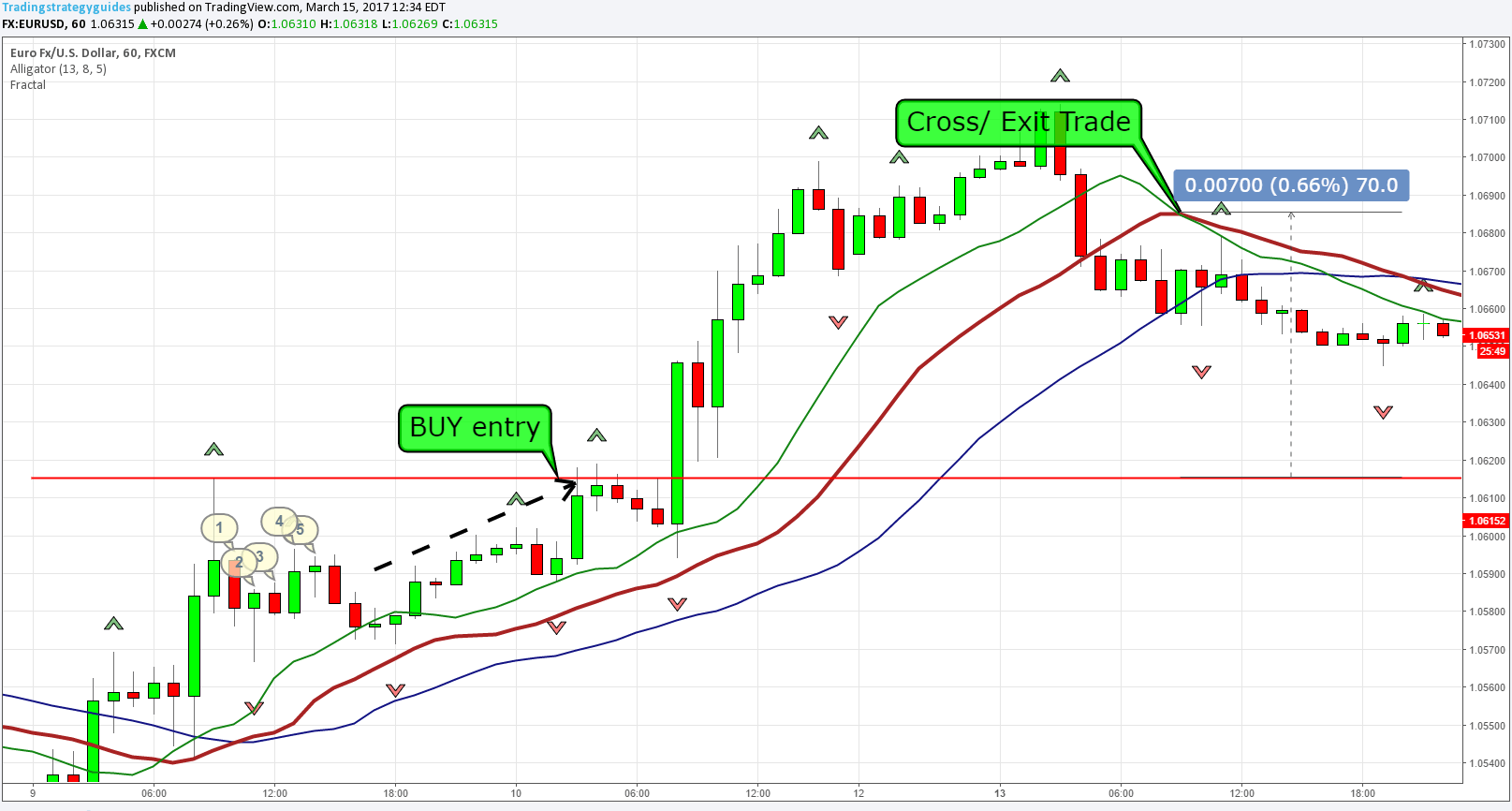

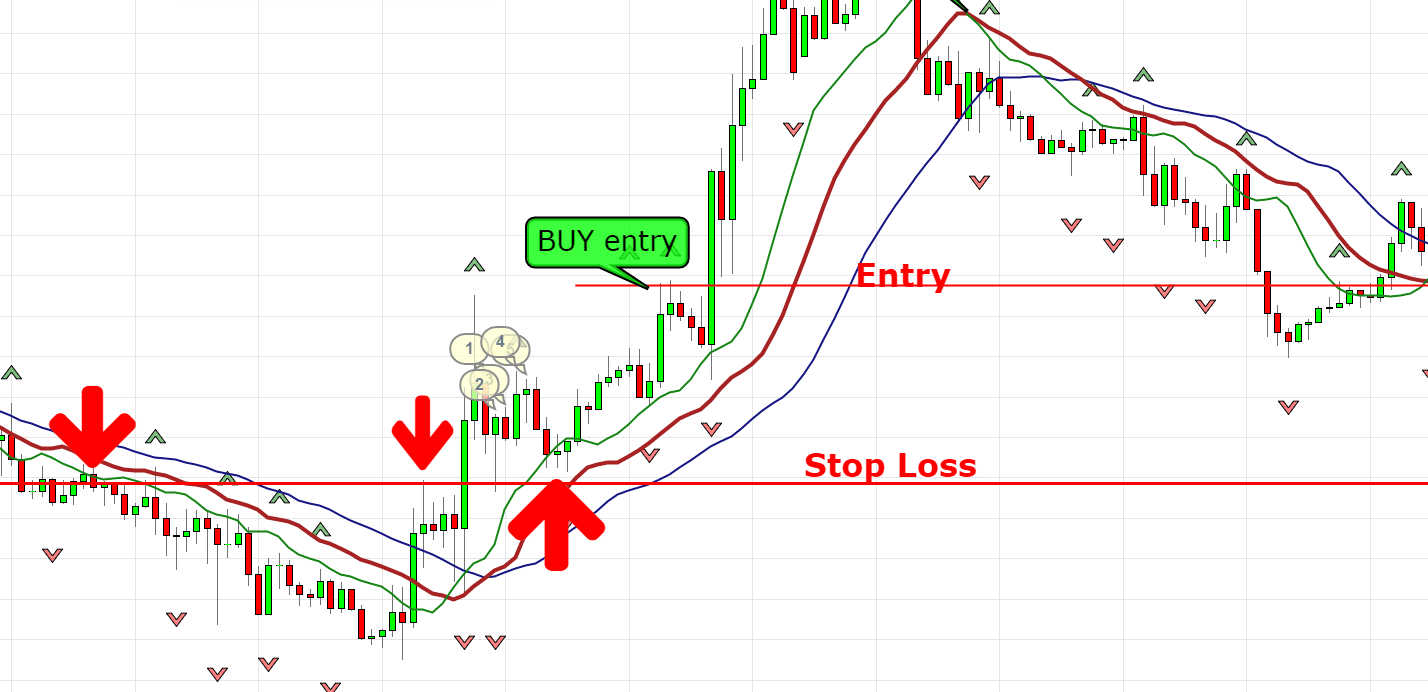

Step #3: Price action must break above the fractal candle discerned in step #1

If you see that five consecutive candles have not made a drastic move to the bottom and remain between the high of the fractal candle and the alligator teeth, we proceed to make an entry order.

You can make an entry this way, or if you sit in front of your charts and live, you can also make a market order. Either is ok to do because the same criteria are needed.

This is what it will look like:

As you can see, I marked where our original fractal was discovered. What happened next was that five or more candles appeared that did not descend to the alligator teeth, did not cross the alligator lines, and the price action finally broke above the fractal candle and thus traded.

Take profit targets / stop loss.

You can try variations on this strategy in terms of take profit and stop loss.

Exit the trade when two of the alligator lines cross over each other.

This probably means that the alligator is going to sleep again and that the price action is going to reverse or consolidate.

With this trade you would be a 70 pip winner.

Place your stop loss below previous support/resistance areas. Check out my other article here that talks about these important areas.

This will give you the best opportunity to save a trade should the price action turn on you and turn into a bearish trend. It may “bounce” off these areas and bounce back in a running direction.

The above were the BUY admission requirements. A sale would be exactly the same, just the opposite.

Here are the steps of the fractal trading strategy in action:

Sell Trade Steps:

Step #1 Apply both fractal and Bill Williams alligator indicators to your chart

Step #2 A downward fractal must appear below alligator teeth and the price action must remain below the alligator teeth for at least 5 consecutive candles.

Step #3 Price action must break below the fractal candle discerned in step #1

Step #4 Exit the trade when two of the alligator lines cross over each other.

Closure

These basic fractal trading techniques should point you in the right direction if you were looking for a good strategy to use with these indicators. There are many different strategies you can use with these indicators, but in our experience we like this combination of the Bill Williams indicators.

Many argue that every indicator is “regressive” and that it rarely shows profitable entries. The Fractal trading strategy uses the combination of price analysis that complements these excellent indicators. So if you’re one of the skeptics, try this strategy and let us know your results.