In general, binary options are relatively short-term investments that require research and technical analysis. Because of this, analyzing and interpreting binary options charts is extremely important to the success of any trader, as it will be difficult to be profitable without knowing the ins and outs of chart reading and technical analysis. These trading charts don’t have to be intimidating and you can be a successful trader by learning how to use charts to help with your overall trading strategy.

Timeframe

Since binary options are often traded on relatively short time frames (Often the end of the day, hours, minutes or even 30 seconds), it is key to analyze charts within a given time frame that matches the trading style or analysis. For example, if you are trading an asset that expires in one hour, looking at charts with a five-year time period will be of little value. Similar timeframes can back each other up, confirming a trade, but the use of unrelated timeframes is limited. Charts can be divided into time frames as follows: 1 minute, 2 minutes, 5, 10, 15, 30, 45, 60, 90, daily, weekly and monthly.

As mentioned above, it can sometimes be beneficial to use multiple timeframes when researching a potential binary options trade. When doing this, look at the longer time frame first – this should provide the overall long-term trend. From there, you can examine a shorter time frame and establish an entry point that you want to get into the trade. As an example, if the daily chart shows bullish signals but the weekly chart shows bearish signals, traders can wait for the daily chart to turn bearish before placing a trade. The long-term trend will then hopefully be less likely to work against the shorter-term trade.

Types of charts for binary options

Candlestick charts

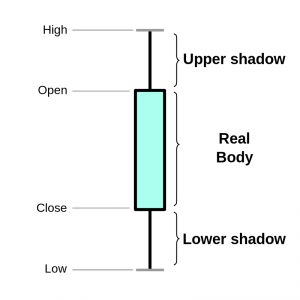

Many technical analysts believe that market trends are a reliable predictor of future events, but they also provide entry and exit points. Looking for indicators on a candlestick chart can help you decide if it’s the right moment to open any puts or calls. Candlestick charts are a visual mix between a line chart and a bar chart, forming a combination that provides more information than is usually available in a more traditional chart. The name “candlestick” comes from the thin bars at the bottom and bottom, which show the high / low range of the day, plus the opening and closing price (so it looks like the wick of a candle). These candles are arranged in the same way as a basic chart, with a new ‘candle’ for each unit. The ‘wicks’, and more importantly, their relative length, can add additional information about the sentiment of the trader.

Many technical analysts believe that market trends are a reliable predictor of future events, but they also provide entry and exit points. Looking for indicators on a candlestick chart can help you decide if it’s the right moment to open any puts or calls. Candlestick charts are a visual mix between a line chart and a bar chart, forming a combination that provides more information than is usually available in a more traditional chart. The name “candlestick” comes from the thin bars at the bottom and bottom, which show the high / low range of the day, plus the opening and closing price (so it looks like the wick of a candle). These candles are arranged in the same way as a basic chart, with a new ‘candle’ for each unit. The ‘wicks’, and more importantly, their relative length, can add additional information about the sentiment of the trader.

A candlestick chart can let traders know whether buyers or sellers are currently winning the argument in terms of the market of a particular asset. Using a candlestick chart along with various technical indicators can push your trading strategy to the next level.

Consult our full article for more in depth analysis of candlestick patterns.

Binary Chart Indicators

There are so many chart indicators to choose from, it can make your head spin. (See Why Price Action Matters) Technical analysis is a big topic and one with very few definitive answers. All charts are useful in their own way, so it is important to understand how and when to use them in your trading strategy. Let’s look at some of them to give you an idea of how they can be used in binary options trading.

Moving Averages – Many binary options traders use moving averages a lot. Some have even built trading strategies that deal with asset prices that move over moving averages over time. A moving average is a trend following indicator based on the historical price of an asset. Moving averages can be calculated in two ways, one in which all historical prices are weighted equally (Simple Moving Average) or in another way where more weight is given to more recent prices (Exponential Moving Average). Bullish and bearish signals are evident when the price of an asset crosses above its moving average, or if there is historical support of the price relative to a moving average.

Moving Average Convergence Divergence (MACD) – MACD is the trend indicator that shows the relationship between multiple moving averages of an asset (the most commonly used values are 12, 26 and 9 day moving averages). Over time, the MACD can display strong bullish or bearish signals depending on when the price of the asset and the MACD indicator diverge, the MACD rises dramatically or there is a crossover of the MACD indicator and the signal line.</ li>

Moving Average Convergence Divergence (MACD) – MACD is the trend indicator that shows the relationship between multiple moving averages of an asset (the most commonly used values are 12, 26 and 9 day moving averages). Over time, the MACD can display strong bullish or bearish signals depending on when the price of the asset and the MACD indicator diverge, the MACD rises dramatically or there is a crossover of the MACD indicator and the signal line.</ li>- Stochastic Oscillators – Stochastic – An indicator that compares the closing price of assets to a specified price period. The theory behind stochastics is that in an uptrending market prices will usually close near their highs, and during a downtrending market prices will close near their lows. Stochastics are usually displayed in a number between 0 and 100 or -100 and 100. Traders start to take notice as soon as the values move past 80 or 20 – if the scale is 0-100.

- Fibonacci Numbers – Fibonacci was a mathematician who identified a series of numbers that repeated in the natural world. Recently, analysts have seen similar patterns occurring frequently in the trading markets as well. It can often be used to determine support and resistance levels.

- Volatility – Not strictly a price chart, but the VIX measure of current volatility is a useful chart to keep an eye on. Especially if trading ‘Greeks’ is important within your trading strategy. Border and ladder options are particularly susceptible to volatility in terms of assessed value.

- Relative Strength Index (RSI) – A Momentum Oscillator that measures the change and speed of price movement. This allows traders to spot assets that are oversold or oversold, and ‘failure swings’. It moves between 0 and 100.

Binary options charts strategies in real time

Although binary options charts can be extremely useful in determining entry points for binary options traders, and can provide valuable insights into the historical performance of an asset, they must be fully understood to be fully utilized. It is also important not to let emotions get in the way of what cards are displayed. If the moving averages have a significant bias to the downside, such as a downward cross, don’t let your emotions tell you that it doesn’t matter. The indicators tell a story that you as a trader should listen to. Using charts can be very rewarding if done correctly, but first you need to educate yourself and determine which patterns and technical indicators you prefer to use in your trading strategy. Each trading strategy will be as individual as the person using it, so there are few ‘right and wrong’ answers when it comes to charting. Demo accounts can be a great place to experiment with trading strategies and see what works.

Best brokers for cards: